bain capital tech opportunities interview

Private equity firm Bain Capital on Thursday said it will acquire a 2498 stake in IIFL Wealth Management Limited for 3679 crore. Bain Capital Associate interview.

Bain Capital Crypto Got Roasted For Being Misogynistic Wall Street Oasis

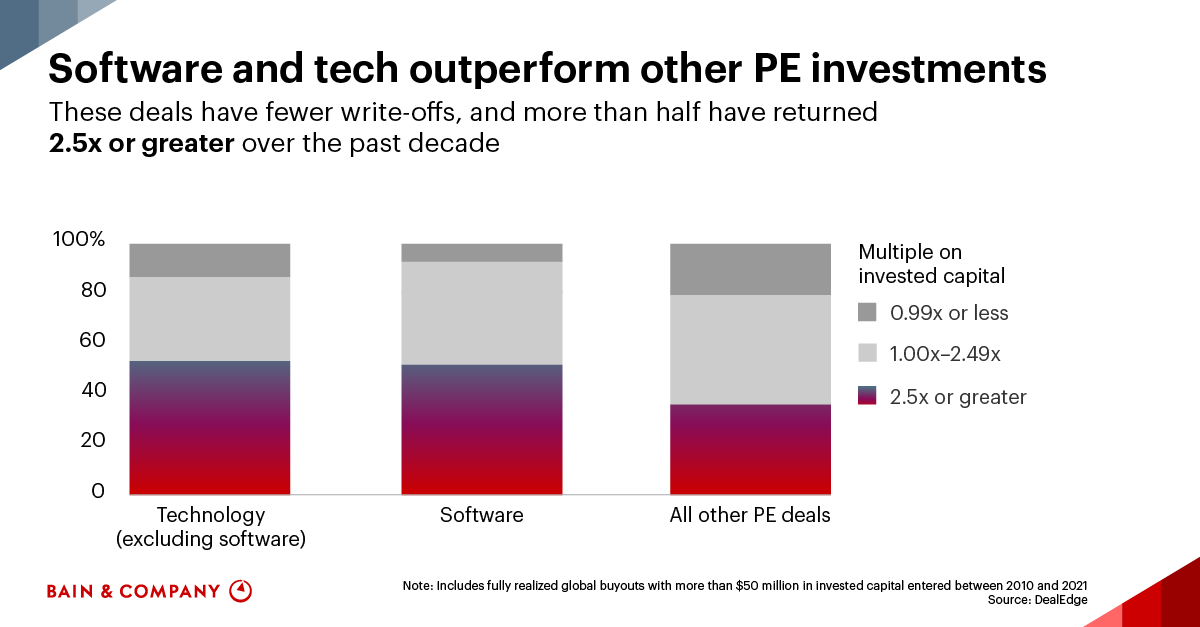

Software deals made up 256 billion or 90 of the total tech value with much of that activity involving public-to.

. Should I be focusing my time studying LBO Finance technicals or preparing for a case interview. 54 interview questions and 49 interview reviews posted anonymously by Bain Capital interview candidates. Wednesday November 24 2021 138 pm.

We combine deep domain expertise with the ability to tap the global reach insight and relationships of the broader Bain Capital platform across the entire technology ecosystem. Scout out opportunities in tech attending conferences meet-ups and demo days. BC Asia Investments X.

Recently was able to snag an off-cycle interview for Bain Capital and was wondering what the first round typically looks like. Common stages of the interview process at Bain Capital according to 51 Glassdoor interviews include. Bain Capital Tech Opportunities Fund.

Break into venture capital as an associate in San Francisco at Bain Capital Ventures the VC arm of Bain Capital. June 9 2021 Esther Surden 1 entrepreneurship Health Tech Innovation News NJ Tech Companies NJ Tech People Startups tech entrepreneurship Tech Workforce Word came last month that Axtria Berkeley Heights a high. TOKYO Toshiba Corps top shareholder said Thursday it has agreed to support a possible takeover bid led by.

Bain Capital Tech Opportunities finalized its agreement to make a R450 million growth investment in Bionexo a leading Latin American cloud software. I am a pre-med student so I just told the truth. October 16 2020.

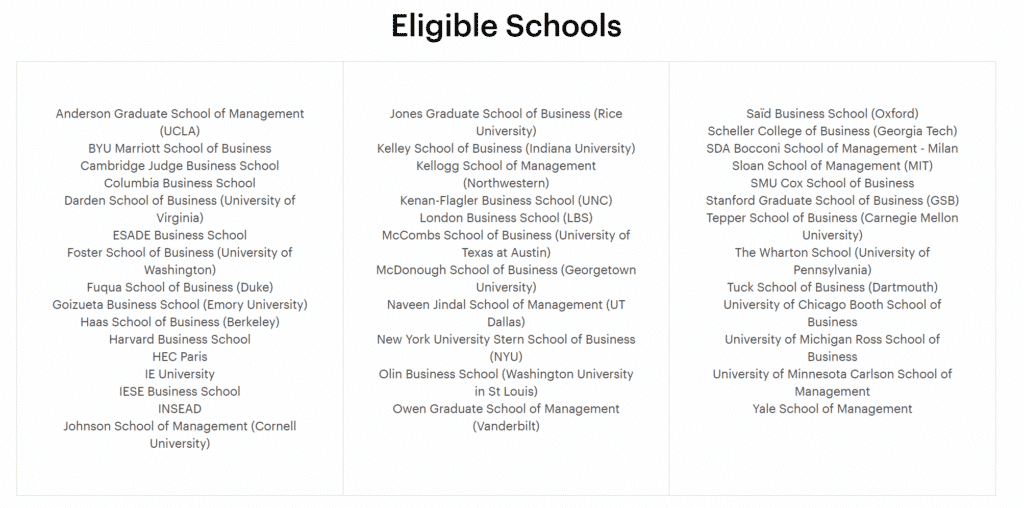

Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 155 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live. Since our founding in 1984 weve applied our insight and experience to organically expand into. Bain Capital Tech Opportunities pursues investments in application software fintech and payments healthcare IT and infrastructure security.

Common stages of the interview process at Bain Capital according to 53 Glassdoor interviews include. Weve done some research and agree with outside sources that the following are some of the top firms by size or influence in the industry. The team combines deep domain expertise with the ability to tap the global reach insight and relationships of the broader Bain Capital platform across the.

However were loathe to assume that one firm or the other is the best because the perfect one is the management consulting firm that best fits your needs and professional development goals. Kirkland Ellis represented Bain Capital Tech Opportunities in the transaction. Bain Capital interview details.

TPG Growth Bain Capital Tech Opportunities on-cycle recruiting also happen now or. 84 of Bain Capital employees would recommend working there to a friend based on Glassdoor reviews. Bain Capital Tech Opportunities Fund secured 107 billion according to a Form D fundraising document.

I applied through college or university. Bain Capital a leading global private multi-asset alternative investment firm on March 31 announced that it has agreed to acquire 2498 percent equity stake in IIFL Wealth Management from General. Went through a case then asked me why I was interested in the internship.

31 2022 826 am ET. One on One Interview. The process took 1 week.

Interview is most likely this week and I want to prioritize topics that are typically. Since our founding in 1984 weve applied our insight and experience to organically expand into several asset classes. Bain Capital which manages more than 100 billion is planning to raise 1 billion for a tech-focused fund that will invest in takeovers.

Earlier this month Bain Capital launched a new 560 million crypto fund coincidentally on International Womens Day and drew backlash for the accompanying picture of the funds all-male. Below is a sample of the. The 284 billion in tech deals private equity investors closed in 2021 accounted for 25 of total buyout value and 31 of deal count during the year comprising by far the largest share for any single sector see Figure 1.

Darren Abrahamson of Bain Capital Tech Opportunities on investing in the downturn K1 to make 26x its money on Checkmarx stake sale FTV Capital invests in Docuspace. Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 155 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year after wrapping up the strategys debut fund with 125 billion.

Bain Capital Tech Opportunities R450 Million Investment in Bionexo. The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to David. Interview with Jassi Chadha Whose Berkeley Heights Life-Sciences Software Company Axtria Recently Raised 150 Million.

Interview with Jassi Chadha Whose Berkeley Heights Life-Sciences Software Company Axtria Recently Raised 150 Million June 9 2021 Esther Surden 1. While Bain Capital appears to have met the target for its new technology offering the firm has not yet held a final close a person with knowledge of the matter told Buyouts. Home Bain Capital Tech Opportunities Fund.

We draw upon a senior team with industry venture capital public equity and private equity investing experience. Pinheiro Guimarães advised Bionexo SA. Interviewer said case was solid and he could tell that I was passionate.

Employees also rated Bain Capital 35 out of 5 for work life balance 41 for culture and values and 43 for career opportunities. One on One Interview. I interviewed at Bain Capital Cambridge MA in Sep 2016.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/NHK6RQ4QO5KJTFZTBMJR7OL44U.jpg)

Exclusive Bain Capital Raises 11 8 Billion For New Flagship Fund Reuters

Getting Into Private Equity With Magdalena Kala Bain Capital By Justine Moore Medium

Private Equity Interview Questions And Answers 40 Samples Wall Street Oasis

Is Your Tech Due Diligence Good Enough Bain Company

Interview Cheat Sheet Bain Capital Ventures Bloomberg Business Business Financial Economic News Stock Quotes

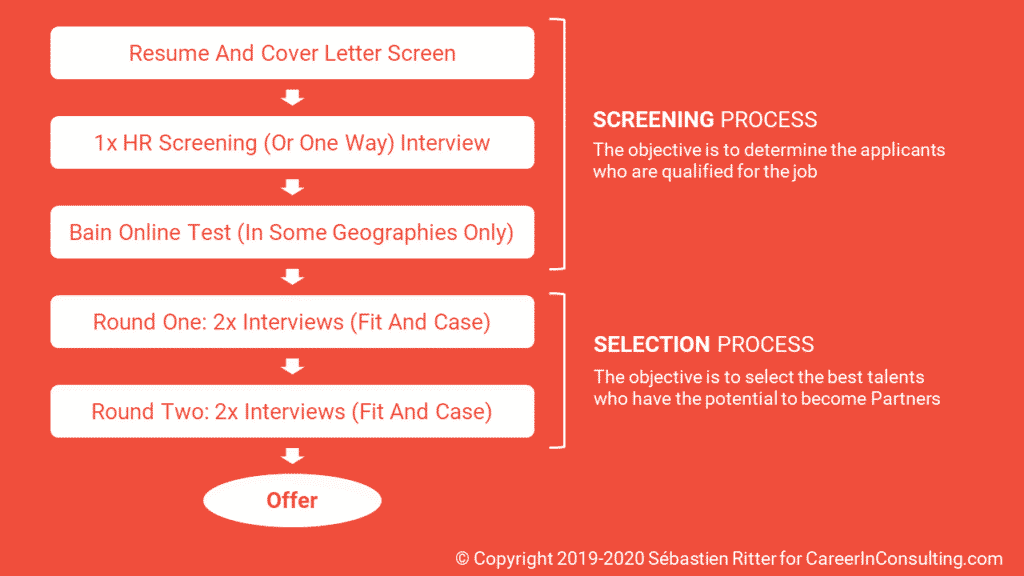

All About Bain Recruitment Process Career In Consulting

Interview Cheat Sheet Bain Capital Ventures Bloomberg Business Business Financial Economic News Stock Quotes

Bain Capital Interview Questions Glassdoor

Anyone Working At Bain Capital Ventures Who Can Provide Their Honest Take On Your Job Work Life Balance Firm Culture And People I M Thinking About Applying For The Associate Position I M Currently In

Shyam Mani Investor Bain Capital Linkedin

Bostinno Cambridge Ai Startup Akkio Gets Seed Funding Led By Bain Capital

Bain Capital Crypto Got Roasted For Being Misogynistic Wall Street Oasis

Bain Capital Hits Target For Tech Fund With Nearly 1 1bn Plans To Keep Raising Buyouts

Bain Capital Ventures Baincapvc Twitter

All About Bain Recruitment Process Career In Consulting

Getting Into Private Equity With Magdalena Kala Bain Capital By Justine Moore Medium